Clocktimizer is now Foundation Scoping!

Why Foundation Scoping?

Boost Profits and Improve Client Service

Harness AI-powered natural language processing to automatically categorize time entries, reducing manual effort and increasing accuracy in matter analysis.

Data-Driven Decision Making

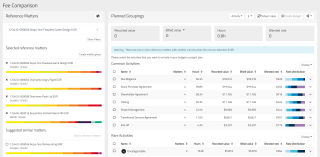

Utilize historical matter data to forecast costs, allocate resources efficiently, and deliver transparent pricing to clients. Understand who does what, when, where, and at what cost to price with confidence, improve internal processes, and increase profitability.

Pricing and Scoping

We help law firms understand value, cost, and predictability, empowering you to respond in real-time to any incoming pricing request. Leveraging AI-driven analytics, we provide deeper insights, enabling more accurate forecasts and smarter pricing decisions.

Legal Matter Management

Firms often run countless numbers of complex matters at once. Foundation Scoping allows you to manage all of your matters in one place, from budget oversight to out-of-scope work notifications, and scale legal project management across the firm.

Practice Analysis

Get answers to questions in a few clicks—from your most profitable practice area to identifying time spent on activities.

See How Foundation Scoping Enables Data-Driven Decision Making

Data-Driven AFAs

Make tailored pricing arrangements with AI-powered insights to help refine pricing strategies for greater accuracy and competitiveness.

Scope for Success

Avoid unexpected costs with advanced scoping and real-time resource management.

Time is Money

Stop playing catch up and start planning with actionable, detail-driven data at the click of a button.

Scalable Legal Project Management

Summarize matter data into an easy-to-understand dashboard with tailored notifications.

No Manual Task Coding

Easily access data with narratives processed by Litera AI+, providing granular insights into your most important matters and clients.

Know Your Most Valuable Clients

Breakdown your client relationships by profitability, team members, and type of work done to understand who’s essential to your firm.

Is your firm ready for data-driven decision making?

Resources

Featured Resources for Foundation Scoping

Learn more about how Foundation Scoping can help your law firm.