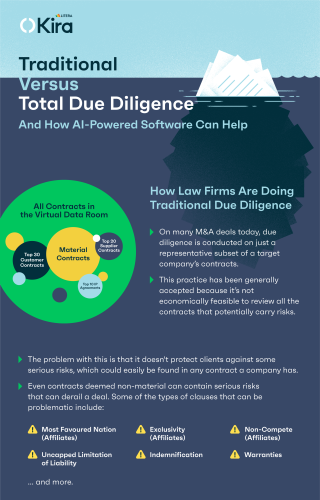

Infographic: Traditional Versus Total Due Diligence and How AI-Powered Software Can Help

In any M&A transaction, it’s important to balance process efficiency and risk identification and mitigation, while recognizing that the consequences of missing contractual language can be serious. As AI-powered contract review and analysis software solutions become increasingly popular, traditional practices for completing legal due diligence in M&A are transforming. Total Diligence enables practitioners to significantly increase the scope of due diligence performed–with broader reviews on bigger sets of documents–in a highly cost-efficient manner.

Scroll through for more details on how Total Diligence helps law practices to complete more comprehensive analyses for their clients with available technology, and for data on diligence scope, cost, and return on investment.